maine tax rates compared to other states

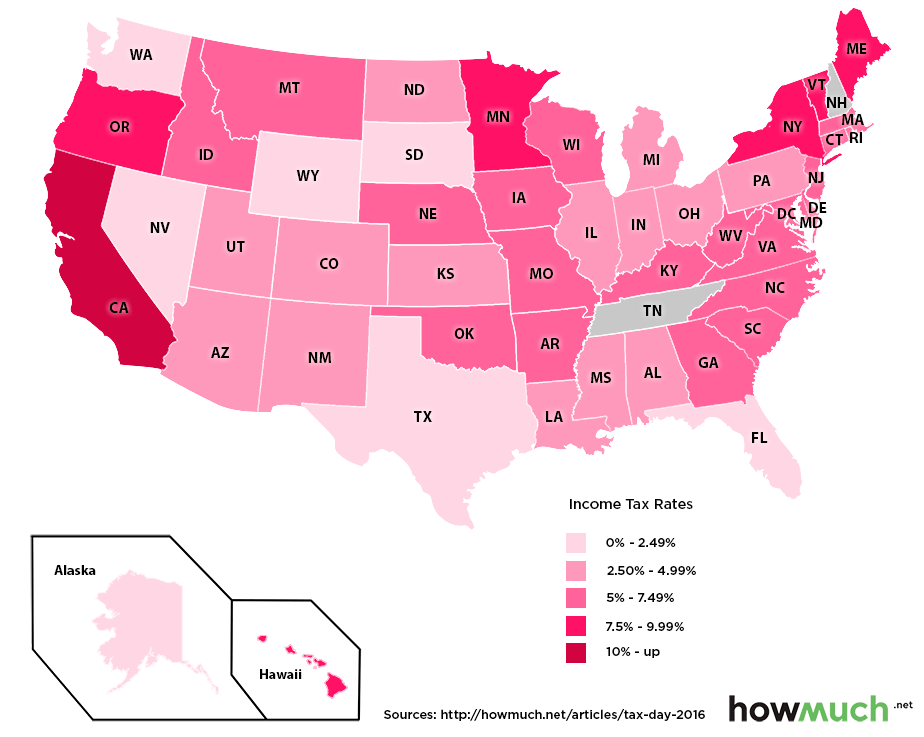

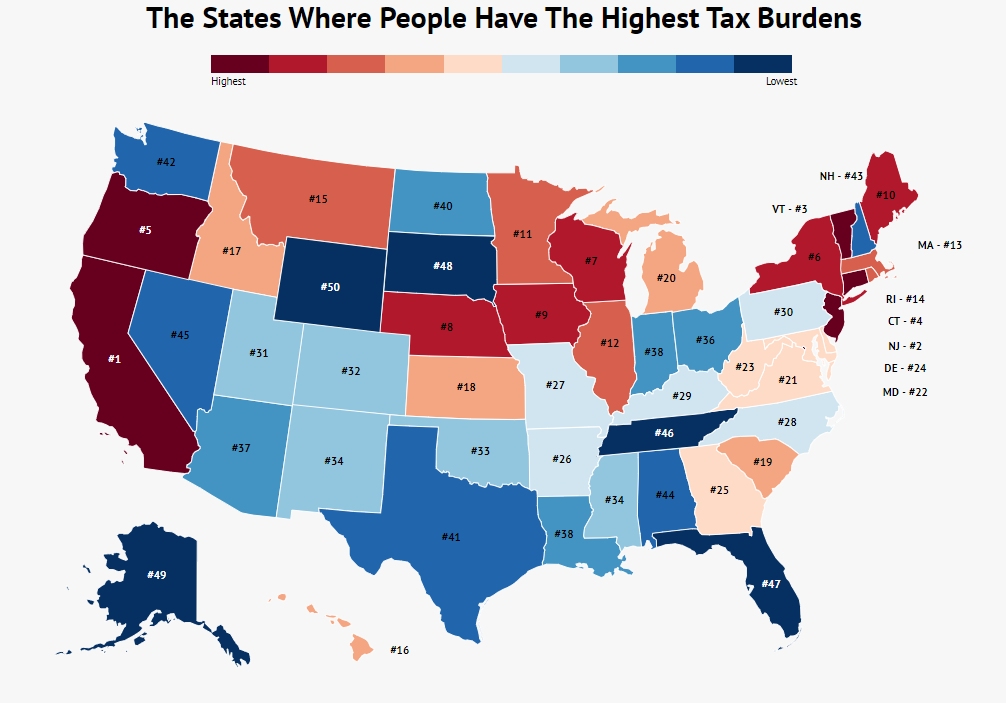

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. To determine the residents with the biggest tax burdens WalletHub compared the 50 states across the three tax types of state tax burdens property taxes individual income taxes and sales and excise taxes as a share of total personal income in the state.

How High Are Capital Gains Taxes In Your State Tax Foundation

Maine also has a corporate income tax that ranges from 350 percent to 893 percent.

. One tax collection area where New Hampshire outpaces its neighbor. Hawaii also holds the second place spot for salesexcise tax collection per capita taking 2394 on average when you have a job in Hawaii. Social security is not taxed but pensions and retirement plans are both partially taxed.

Up to 20 cash back 2. For income taxes in all fifty. How high are sales taxes in Maine.

Vehicle Property Tax Rank Effective Income Tax Rate. Maine State Tax Rates. Effective Real-Estate Tax Rate.

Residents of Maine are also subject to federal income tax rates and must generally file a federal income. The states top rate still ranks as one of the highest in the US. For income taxes in all fifty states see the income tax.

According to the Tax Foundation the five states with the highest top marginal individual income tax rates are. No state sales tax. Your 2021 Tax Bracket to See Whats Been Adjusted.

Hawaii and Maine Hawaii Top tax rate. Maines percentage was 105 slightly more than the portion in. 15th Individual income tax burden 269 24th Total sales and excise tax burden 353.

Maines tax system ranks 33rd overall on our 2022 State Business Tax Climate Index. And of course Washington DC. Restaurants In Matthews Nc That Deliver.

Is not a state but it has its own income tax rate. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Vehicle Property Tax Rank Effective Income Tax Rate.

Maine Tax Rates Compared To Other States. Opry Mills Breakfast Restaurants. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

The Maine Single filing status tax brackets are shown in the table below. Delivery Spanish Fork Restaurants. Income Tax Rank Effective Sales Excise Tax Rate.

Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes anywhere in the state. Maine has a 550 percent state sales tax rate and does not levy any local sales taxes. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

Seniors also benefit from a number of major sales tax exemptions. Sales Excise Tax Rank Effective Total State Local Tax Rates on Median US. Maine Middle class tax rate.

Maine Tax Rates Compared To Other States. MAINE STATE 03901 550 MAINE STATE 03902 550 MAINE STATE 03903 550 MAINE STATE 03904 550 MAINE STATE 03905 550 MAINE STATE 03906 550 MAINE STATE 03907 550 MAINE STATE 03908 550 MAINE STATE 03909 550 MAINE STATE 03910 550 MAINE STATE 03911. Office of Tax Policy.

MEETRS File Upload Specifications. The five states with the lowest top marginal individual income tax rates are. Tax Relief Credits and Programs.

13 rows Other Taxes. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. Hawaii and Maine Hawaii Top tax rate.

Essex Ct Pizza Restaurants. Income Tax Rate Indonesia. The income tax rates in maine range from 58 to 715.

The income tax rates in maine range from 58 to 715. Real-Estate Tax Rank Effective Vehicle Property Tax Rate. Table 2 compares state and local tax revenue by source and shows that while one form of taxation is high in a given state that same state might collect less money through other means of taxation.

These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. This year Uncle Sam will take his cut of the past years earnings on May 17 slightly later than usual due to the COVID-19 pandemic. For more information about the income tax in these states visit the Maine and Pennsylvania income tax pages.

Maine Sales Tax Comparison Calculator for 202223 Maine applies a flat rate of Sales Tax across the State so we do not provide a Sales Tax comparison for each location in. One tax collection area where New Hampshire outpaces its neighbor. New York has the highest overall tax burden at 1304 while Alaska at 494 had the lowest.

Unable to retrieve data. Welcome to Maine FastFile. For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

The taxes were ranked as a percentage of total personal income in each state. Use this tool to compare the state income taxes in Maine and Pennsylvania or any other pair of states. Ad Compare Your 2022 Tax Bracket vs.

Soldier For Life Fort Campbell. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that. 531 2 2.

Grow Your Legal Practice. Discover Helpful Information and Resources on Taxes From AARP. 51 rows Up to 25 cash back See how your states tax burden compares with other states.

March 1 2022. This tool compares the tax brackets for single individuals in each state. 548 1 251 21 343 24 4.

These income tax brackets and rates apply to Maine taxable income earned January 1 2020 through December 31 2020. Maine Tax Rates Compared To Other States. Including federal taxes if you have a job in Maine your total marginal income tax rate will be 518 percent.

Therefore 55 is the highest possible rate you can pay in the entire state of Maine. Maine generally imposes an income tax on all individuals that have Maine-source income.

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainmen Educational Service Burden Tax

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

State Income Tax Rates Highest Lowest 2021 Changes

2022 Federal Payroll Tax Rates Abacus Payroll

The States Where People Are Burdened With The Highest Taxes Zippia

States With Highest And Lowest Sales Tax Rates

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Most And Least Tax Friendly Us States

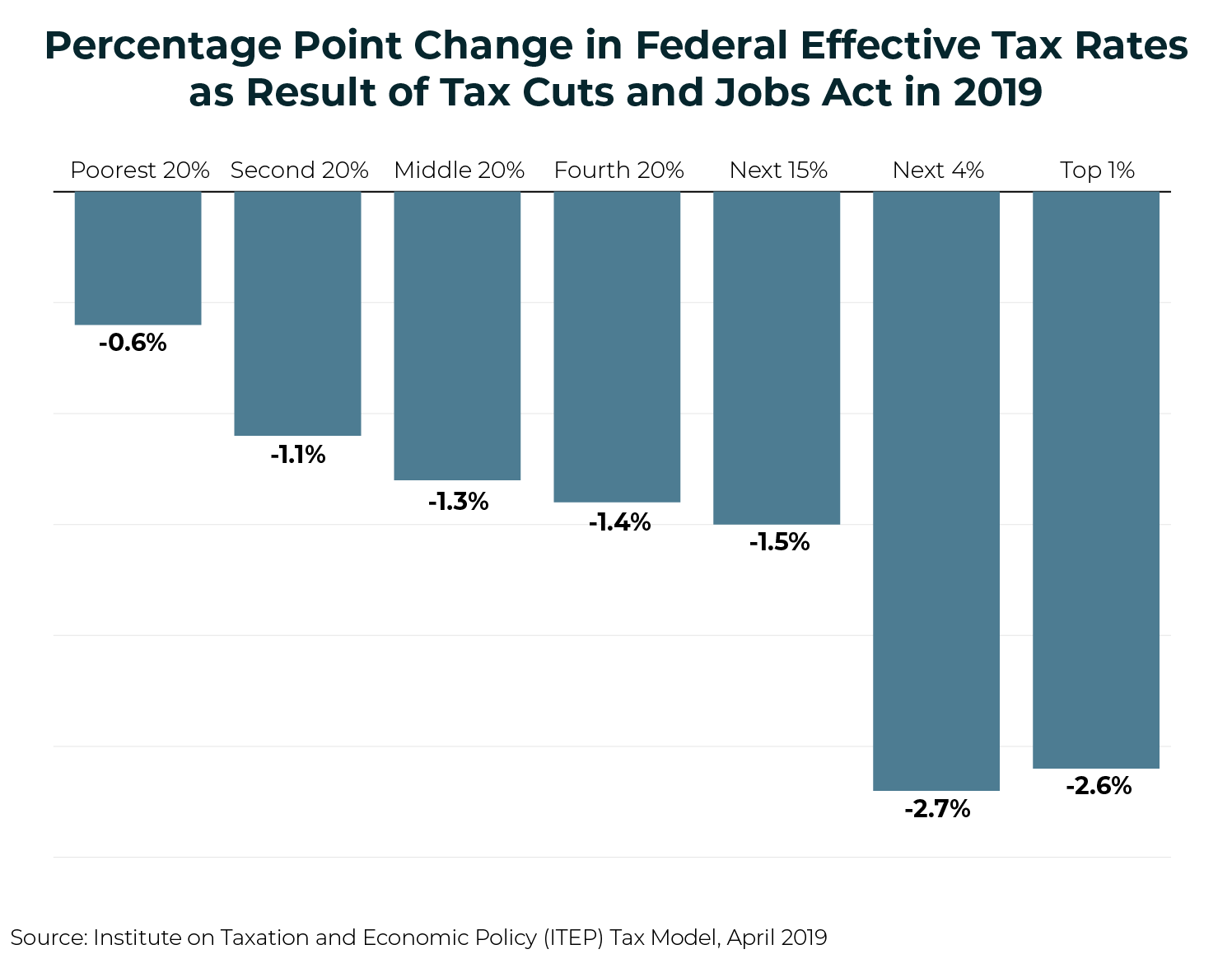

Who Pays Taxes In America In 2019 Itep

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation